Environmental Initiatives

ENVIRONMENT

Addressing Climate Change

Information Disclosure Based on TCFD Recommendations

Teikoku recognizes that responding to climate change is one of the most important management issues to enrich people's spirits and contribute to the realization of a sustainable society through our business activities.

Our main product, the canned motor pump, has a completely leak-free structure and is capable of handling liquids with high environmental impact without leaking.

Our mission is to expand sales of our canned motor pumps around the world, and through our business, we can contribute to the global environment and the safety of people around the world. In addition to reducing greenhouse gas (GHG) emissions and promoting diversity within the company, we are also appropriately addressing each area of ESG such as continuously strengthening corporate governance, including compliance.

In accordance with the recommendations of TCFD*1, we are committed to disclosing climate-related information properly by analyzing the impact of climate change-related risks and opportunities on our business.

In June 2023, Teikoku expressed its support for the Task Force on Climate-related Financial Disclosures (TCFD).

*1 What is TCFD?

Task Force on Climate-related Financial Disclosures

It is an information disclosure standard established by the Financial Stability Board (FSB) in 2015 at the request of the G20 to consider climate-related disclosures and responses by financial institutions.

Our main product, the canned motor pump, has a completely leak-free structure and is capable of handling liquids with high environmental impact without leaking.

Our mission is to expand sales of our canned motor pumps around the world, and through our business, we can contribute to the global environment and the safety of people around the world. In addition to reducing greenhouse gas (GHG) emissions and promoting diversity within the company, we are also appropriately addressing each area of ESG such as continuously strengthening corporate governance, including compliance.

In accordance with the recommendations of TCFD*1, we are committed to disclosing climate-related information properly by analyzing the impact of climate change-related risks and opportunities on our business.

In June 2023, Teikoku expressed its support for the Task Force on Climate-related Financial Disclosures (TCFD).

*1 What is TCFD?

Task Force on Climate-related Financial Disclosures

It is an information disclosure standard established by the Financial Stability Board (FSB) in 2015 at the request of the G20 to consider climate-related disclosures and responses by financial institutions.

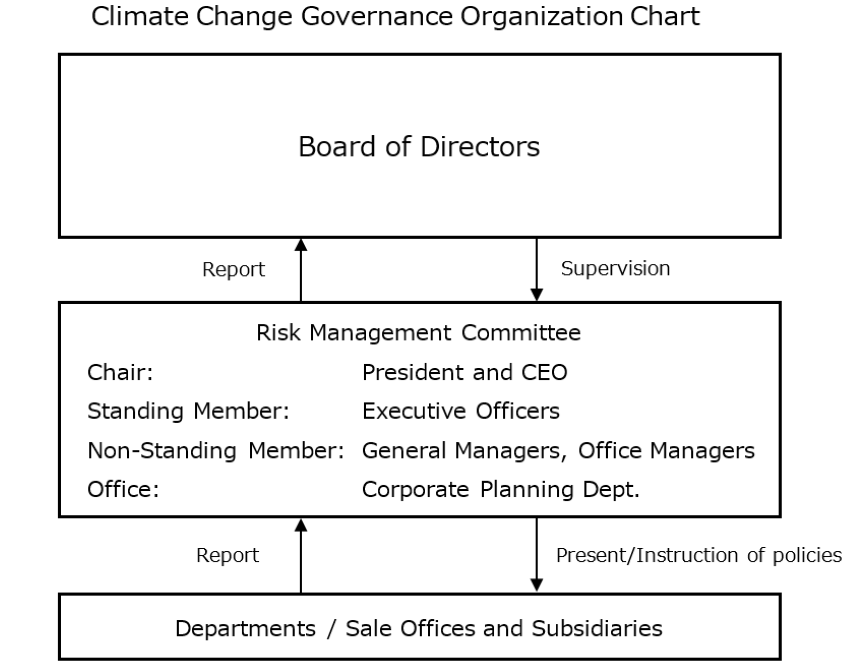

Governance

Our Risk Management Committee, chaired by the President & CEO and with executive officers serving as standing members, examines issues related to climate change. The Committee meets three times a year in principle to extract, analyze, and evaluate various risks and opportunities, including those related to climate change, and to deliberate and decide on policies for dealing with these risks and opportunities.

The items deliberated and decided by the Risk Management Committee are reported to the Board of Directors twice a year, and the Board of Directors upon receiving the reports, gives instructions as necessary to appropriately supervise our response policies and action plans for climate change.

The items deliberated and decided by the Risk Management Committee are reported to the Board of Directors twice a year, and the Board of Directors upon receiving the reports, gives instructions as necessary to appropriately supervise our response policies and action plans for climate change.

Strategies

Premise

The TCFD recommends conducting "scenario analysis" based on multiple climate-related scenarios in order to consider the impact of climate change on business. Therefore, we conducted the following scenario analysis to develop and examine our business strategies for an uncertain future.

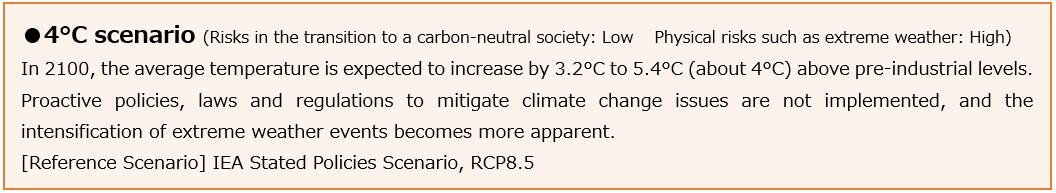

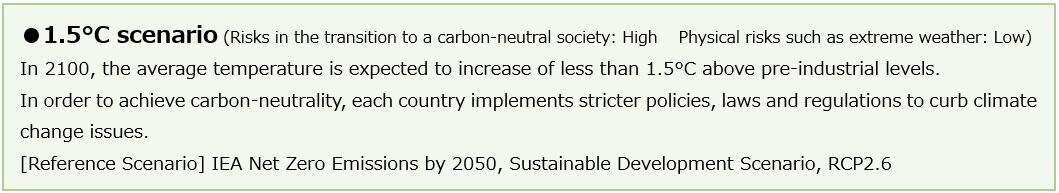

In this scenario analysis, we assume a time point of 2030, which is the target of the SDGs, and considered both qualitative and quantitative aspects by referring to the "4°C scenario" that assumes climate change countermeasures beyond the current level will not be taken and extreme weather events will intensify, and the "1.5°C scenario (with the 2°C scenario in some cases)" that assumes more ambitious climate change countermeasures will be implemented toward decarbonization.

In this scenario analysis, we assume a time point of 2030, which is the target of the SDGs, and considered both qualitative and quantitative aspects by referring to the "4°C scenario" that assumes climate change countermeasures beyond the current level will not be taken and extreme weather events will intensify, and the "1.5°C scenario (with the 2°C scenario in some cases)" that assumes more ambitious climate change countermeasures will be implemented toward decarbonization.

Overview of climate change-related risks and opportunities in our business

| Type of Risk/Opportunity | Term | Impact | Response Policy | |||

|---|---|---|---|---|---|---|

| Transition risk (1.5℃ scenario) |

Regulatory risk |

Introduction of carbon pricing | Operating costs will increase due to taxation of GHG emissions related to the company in line with the introduction of carbon pricing. | Medium to long | Medium | - Reduce energy consumed and GHG emitted in manufacturing processes by introducing energy-saving equipment. - Promote multi-vendor purchasing, review appropriate inventory levels. - Consider alternative materials and evaluate their performance. |

| If regulations related to GHG emissions are introduced or strengthened in each country or region, prices will be passed on to raw materials and procurement costs will increase. | Medium to long | Medium | ||||

| Policies for renewable energy and energy saving | Operating costs will increase due to measures such as the introduction of renewable energy and energy-saving facilities and the switch to renewable electricity in line with the introduction and strengthening of GHG emission regulations. | Medium to long | Medium | - Reduce energy consumed and GHG emitted in the manufacturing process by introducing energy-saving equipment. | ||

| Recycling regulations | If recycling regulations are introduced, costs will be incurred with changing to alternative materials or changing to recyclable specifications for the metals used in our products. | Medium to long | Medium | - Maintain and expand the market through design compliance with various domestic and international laws, regulations, and standards. | ||

| Market risk |

Increase in electricity prices | Operating costs will increase due to higher electricity prices resulting from increased demand for renewable energy. | Medium to long | Medium | - Reduce energy consumed in the manufacturing process by introducing energy-saving equipment. - Reduce the carbon footprint of products and services by using digital technologies. - Strengthen product development and sales to meet the needs of the carbon-neutral market. - Strengthen production system for high value-added products, reduce cost, improve quality, reduce lead-times. |

|

| Increase in raw material prices | Production costs will increase due to higher raw material prices resulting from increased demand for metals due to the development and advancement of carbon-neutral technologies. | Medium to long | Medium | |||

| Change in demand for key products | Demand for our products used in the manufacture of petroleum-derived products such as plastics and in power generation businesses with high environmental impact will decrease as a result of the development of a carbon-neutral society. | Medium to long | Medium | |||

| Reputation risk |

Change in customer reputation | If the efforts to save energy, reduce metal use, or reduce GHG emissions in the manufacturing process of our products are judged by customers as insufficient consideration of climate change, the number of customers will decrease. | Medium to long | Medium | - Take measures and enhance information disclosure for climate change. | |

| Change in investor reputation | If the efforts to reduce GHG emissions or information disclosure are judged by investors as insufficient, there are possibilities of reduced funding, share price declines, and divestments. | Medium to long | Medium | |||

| Physical risk (4℃ scenario) |

Acute | Intensification of extreme weather | Temporary suspension of production resulting from disruption of logistics and shutdown of factory operations due to intensification of natural disasters will lead to a decrease in sales and expenses for recovering from the disasters. | Short to medium | Medium | - Regularly review and improve the effectiveness of BCP. - Promote multi-vendor purchasing and develop new business partners. - Establishment of remote work environment and backup of critical data. - Flexibly respond through recovery support such as providing loans. |

| Opportunity | Introduction and strengthening of laws and regulations | - Government subsidies and intervention in sales prices to promote renewable energy will lead to increased demand for renewable energy, and that will increase product demand for related businesses. - Increased demand for biodegradable plastics and chemical recycling for regulatory compliance will lead to increased demand for our products and after market service from plastic manufacturers and chemical-related businesses. |

Medium to long | High | - Reduce energy consumption by improving pump and motor efficiency. - Strengthen product development and sales to meet the needs of the carbon-neutral market. |

|

| Spread of technologies for renewable energy and energy saving | Demand for our products for renewable fuels (SAF, hydrogen, biomass), CCS and CCUS (carbon capture and storage technology), renewable energy generation, and chemical recycling in the carbon-neutral sector will increase. | Medium to long | High | |||

- Definition of “Term”

“Short": up to 3 years, "Medium": 4 to 10 years, "Long": 11 to 30 years

- Definition of “Impact”

“High”: Impact on operating income is expected to be 500 million yen or more.

“Medium”: Impact on operating income is expected to be between 50 million yen and 500 million yen.

“Low”: Impact on operating income is expected to be less than 50 million yen.

“Short": up to 3 years, "Medium": 4 to 10 years, "Long": 11 to 30 years

- Definition of “Impact”

“High”: Impact on operating income is expected to be 500 million yen or more.

“Medium”: Impact on operating income is expected to be between 50 million yen and 500 million yen.

“Low”: Impact on operating income is expected to be less than 50 million yen.

For the pump business, which is our core business, a large amount of fuel and electricity and a wide variety of metals as raw materials are used in the manufacturing process of our products. Thus, we have identified policies and regulations regarding carbon pricing, rising metal prices due to the transition to decarbonization, and rising electricity prices associated with the market penetration of renewable energy as transition risks. In addition, we have identified the impact of disruptions in logistics related to our supply chain and damage to our business sites due to intensification of extreme weather events caused by climate change as a physical risk.

On the other hand, we have identified the increased demand for our products and services in the carbon-neutral sector, such as the spread of renewable energy and increased production of renewable fuels due to the progress of the carbon-neutral society as opportunities.

On the other hand, we have identified the increased demand for our products and services in the carbon-neutral sector, such as the spread of renewable energy and increased production of renewable fuels due to the progress of the carbon-neutral society as opportunities.

Initiatives to Reduce Environmental Impact

In order to contribute to the global environment and people's safety through our business, our mission is to expand worldwide sales of our canned motor pumps, which have a completely leak-free structure and can transfer liquids with a high environmental impact without leaking.

What is “Canned Motor Pump”?

Canned motor pumps used in the carbon-neutral business

Risk Management

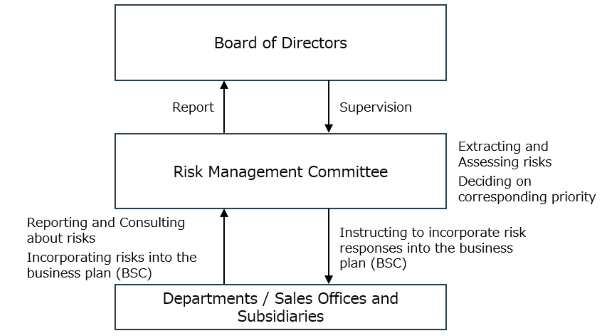

The Risk Management Committee extracts, analyzes, and evaluates risks related to climate change and determines policies for dealing with these risks, along with company-wide risks.

The contents and results deliberated at the Risk Management Committee are reported to the Board of Directors, and the Board of Directors supervises the Risk Management Committee by giving instructions to the Committee as necessary.

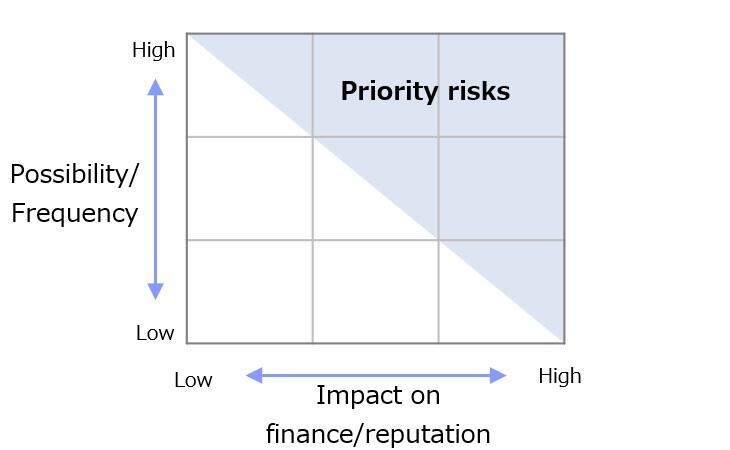

Specifically, in February, the Risk Management Committee Office conducts a risk questionnaire survey of all standing committee members except for the committee chair to extract risks. The Risk Management Committee Office then creates a matrix of the extracted risks based on their possibility and frequency of occurrence and their impact on our finances and reputation, and the Risk Management Committee discusses and determines the priority of the response. As a result, the committee decides which department will be responsible to handle the risk with the highest priority, and the Chief of the relevant department (standing member) instructs the General Manager / Office Manager of the department (non-standing member) to incorporate the relevant risk responses into the department's business plan (BSC). The progress of risk responses incorporated into the business plan (BSC) is checked at the quarterly BSC progress meeting. The results are reported to the Board of Directors through the Risk Management Committee Office. Upon receiving the report, the Board of Directors supervises the Risk Management Committee by giving instructions to the Committee as necessary.

The contents and results deliberated at the Risk Management Committee are reported to the Board of Directors, and the Board of Directors supervises the Risk Management Committee by giving instructions to the Committee as necessary.

Specifically, in February, the Risk Management Committee Office conducts a risk questionnaire survey of all standing committee members except for the committee chair to extract risks. The Risk Management Committee Office then creates a matrix of the extracted risks based on their possibility and frequency of occurrence and their impact on our finances and reputation, and the Risk Management Committee discusses and determines the priority of the response. As a result, the committee decides which department will be responsible to handle the risk with the highest priority, and the Chief of the relevant department (standing member) instructs the General Manager / Office Manager of the department (non-standing member) to incorporate the relevant risk responses into the department's business plan (BSC). The progress of risk responses incorporated into the business plan (BSC) is checked at the quarterly BSC progress meeting. The results are reported to the Board of Directors through the Risk Management Committee Office. Upon receiving the report, the Board of Directors supervises the Risk Management Committee by giving instructions to the Committee as necessary.

Risk Management Organization Chart

Risk Assessment Materiality

Metrics and Targets

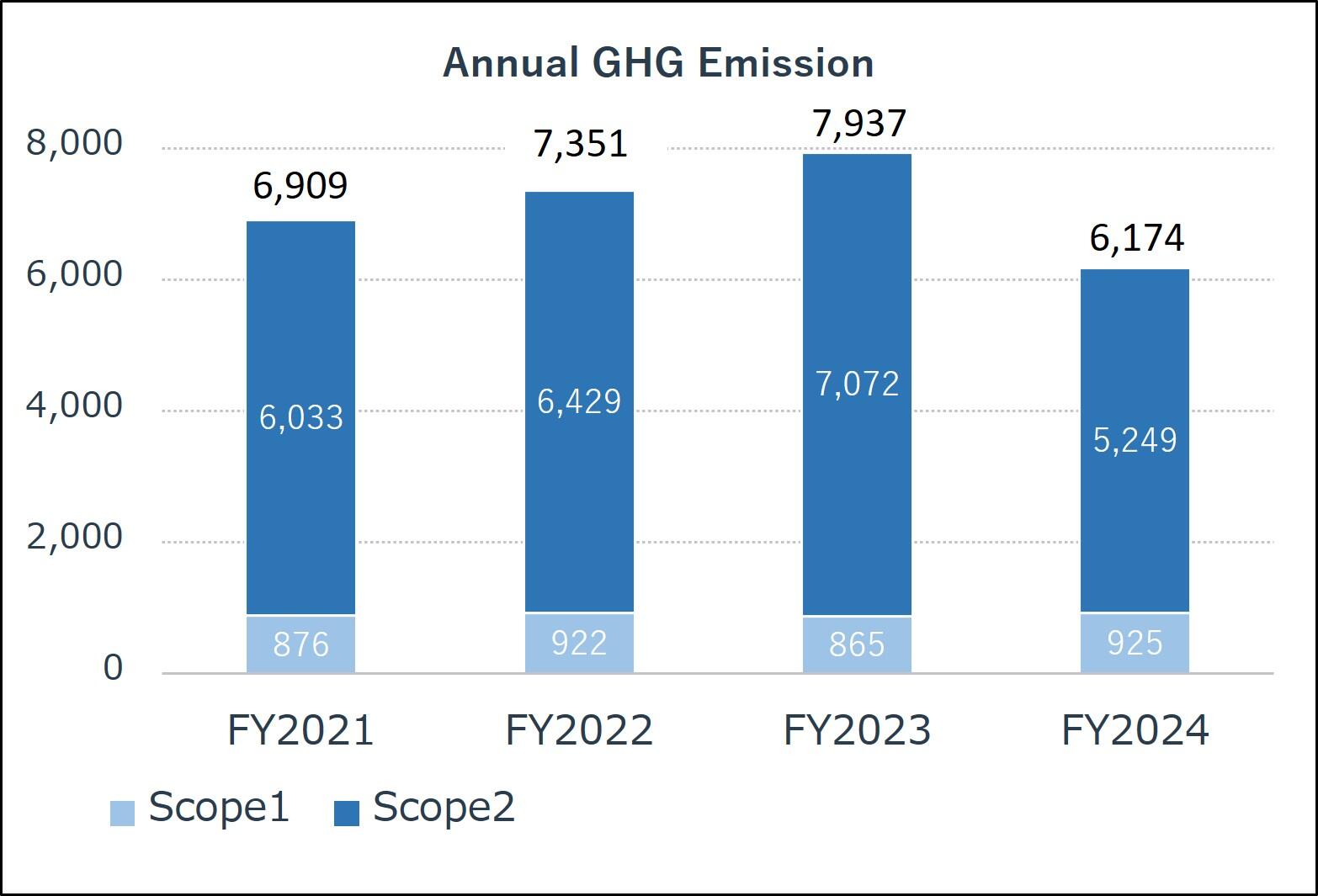

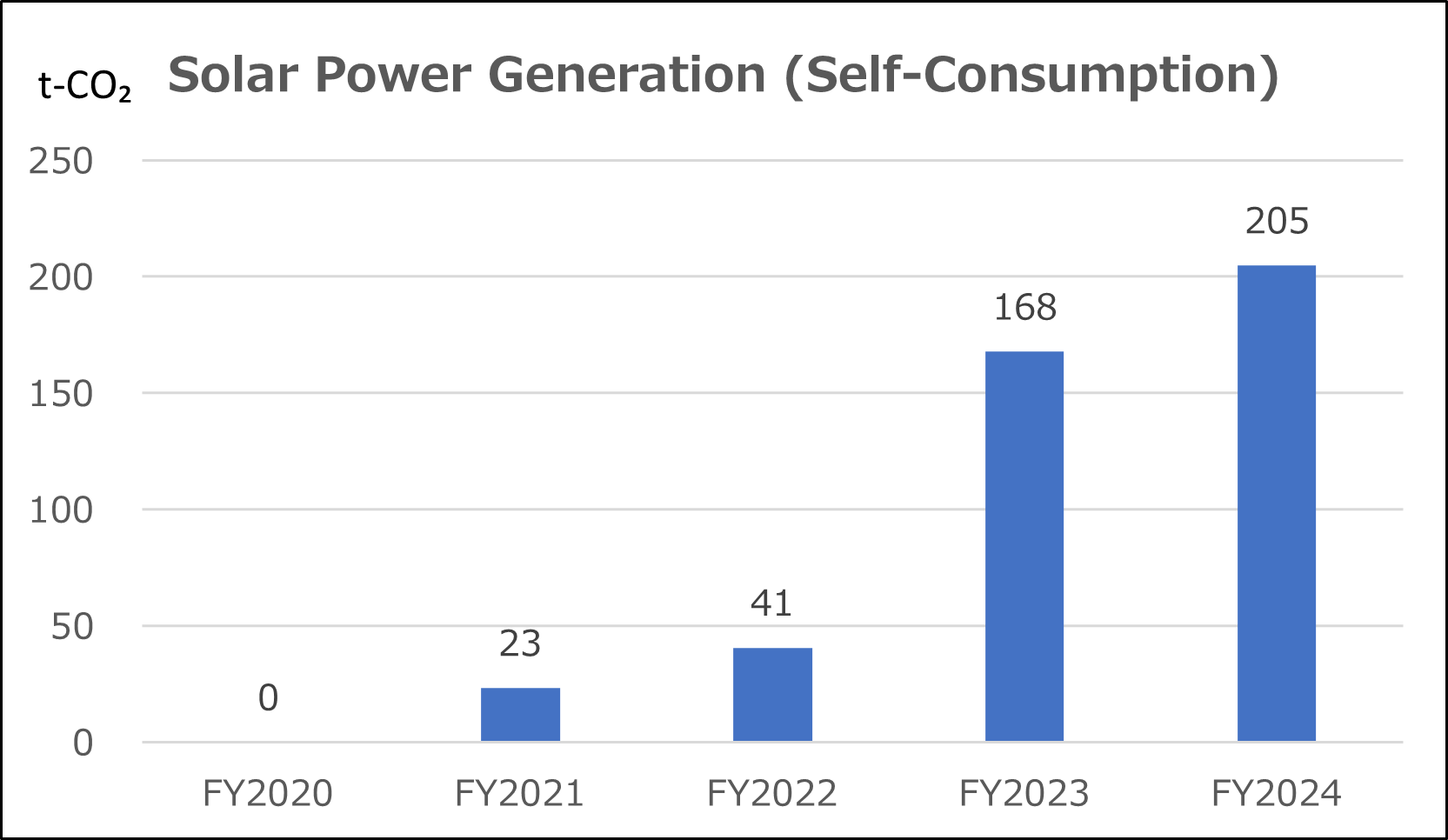

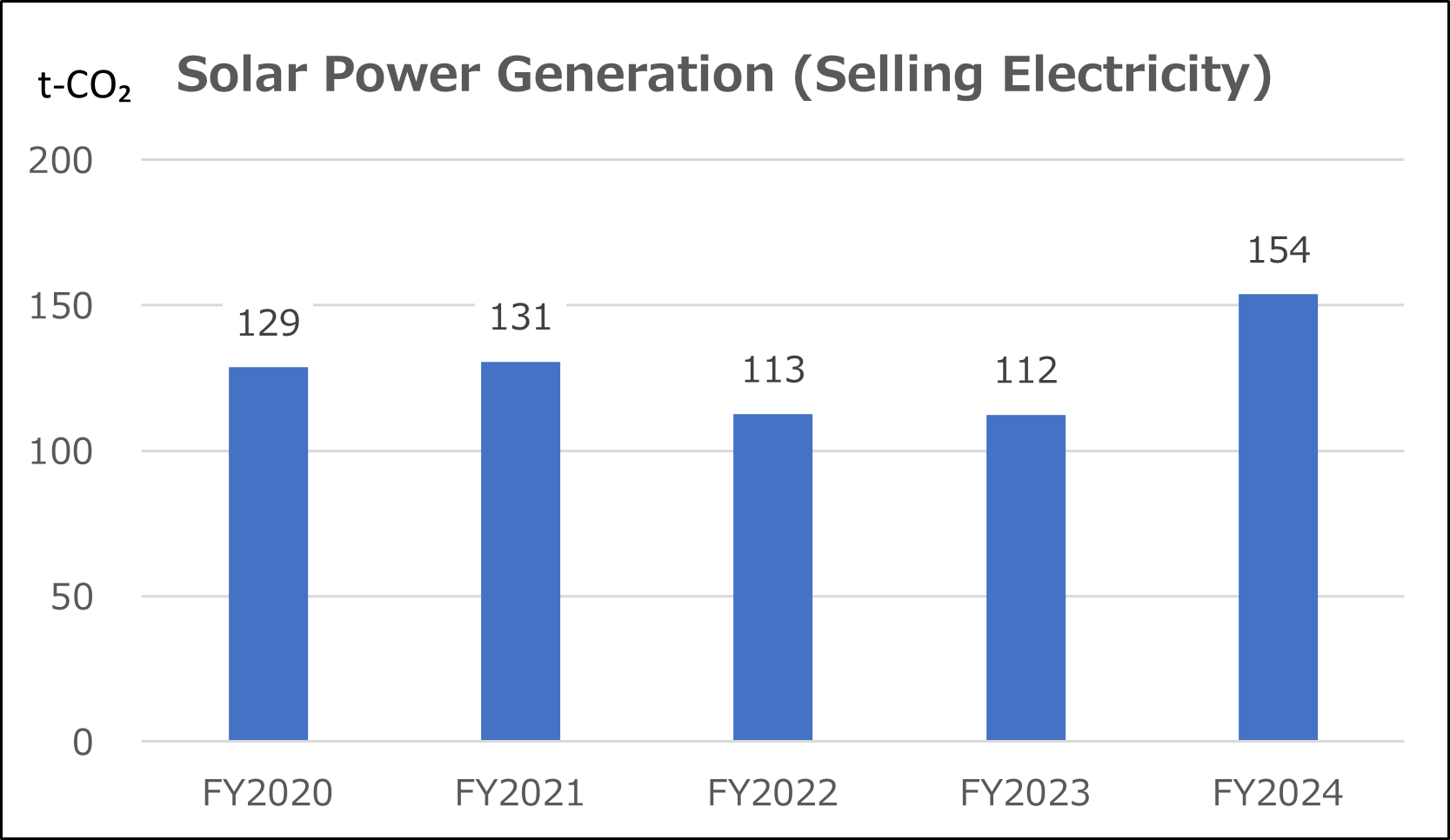

We have selected greenhouse gas (GHG) emissions as an evaluation metric to measure the progress of our environmental management regarding climate change.

We are committed to complying with the global long-term goal set forth in the Paris Agreement calling for efforts to limit the increase in the global average temperature to below 2°C above pre-industrial levels, and to the greatest extent possible, 1.5°C above pre-industrial levels, and the Japanese government's goal of achieving carbon neutrality, which means zero GHG emissions as a whole by the year 2050.

In the future, we will consider calculating Scope 3 emissions to grasp the emissions of the entire supply chain. The actual Scope 1 and Scope 2 GHG emissions of our manufacturing, sales, and service sites in Japan and overseas are as follows.

We are committed to complying with the global long-term goal set forth in the Paris Agreement calling for efforts to limit the increase in the global average temperature to below 2°C above pre-industrial levels, and to the greatest extent possible, 1.5°C above pre-industrial levels, and the Japanese government's goal of achieving carbon neutrality, which means zero GHG emissions as a whole by the year 2050.

In the future, we will consider calculating Scope 3 emissions to grasp the emissions of the entire supply chain. The actual Scope 1 and Scope 2 GHG emissions of our manufacturing, sales, and service sites in Japan and overseas are as follows.

* The data of overseas subsidiaries is collected and calculated in accordance with their fiscal years.

* As the "Feed-in Tariff (FIT) for Renewable Energy" is used, the figures are provided for reference only.